The correct number of shares should be provided to 3 decimal places.

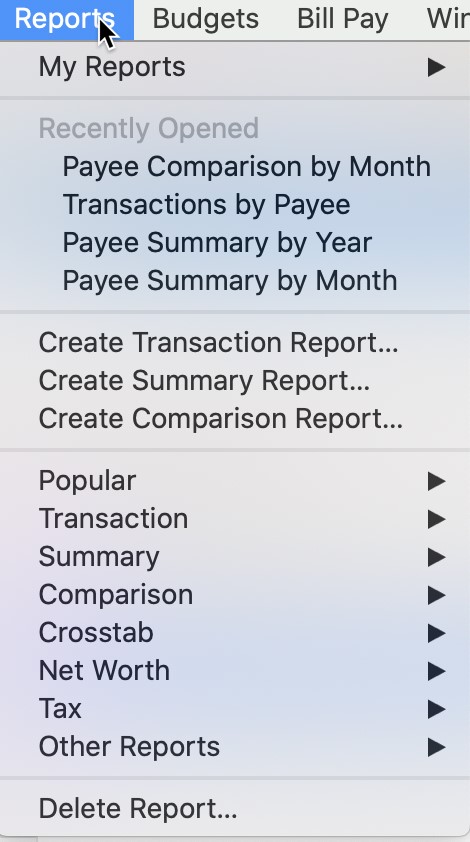

Remark: as of, the number of shares is rounded to 2 decimal places in the report. You can then export the report as a CSV or TXF file (e.g., to TurboTax). At the top of the window, click on the “Save” button and provide a name for the custom report. In the “Edit Report” window, set the “Date range” as desired. Do not select short-term capital gain or long-term capital gain, which are distributions and not sales. Select those category associated with Investments and Tax Form Schedule D for buying and selling investments (e.g, buy, buy bonds, reinvest long-term capital gain, reinvest short-term capital gain, sell, sell bonds). In the “Edit Report” window, ensure the Categories tab is selected and click on the radio button for “Include only transactions with selected categories”.Ĩ. De-select every account except for the taxable accounts in which you have capital gains (e.g., brokerage accounts, mutual fund accounts, etc.). In the “Edit Report” window, ensure the Accounts tab is selected and click on the radio button for “Selected accounts”.ĥ. At the top of the window, click on the “Edit” button.Ĥ. Choose the option to “Summarize by: Category”.ģ. Open the report, Quicken Reports > Tax > Tax Schedule.Ģ. To get automatic bank fees, you’ll need to pay at least 9.95 a month, or 7.50 a month when paid annually. While there is a free version of PocketSmith, it requires manual data entry.

#Quicken mac set date range for tax schedule how to

How to create a Capital Gains report with subscription Quicken for Mac:ġ. It also has a cash flow feature that maps income and spending by date range. (I'm using Quicken Subscription for Mac.) I've found a way to modify the Tax Schedule report to create a Capital Gains Report. However, there is no standard report for Mac users. Quicken Windows users can run a Capital Gains Report.

I'm answering my own question, to post this idea to the community.

0 kommentar(er)

0 kommentar(er)